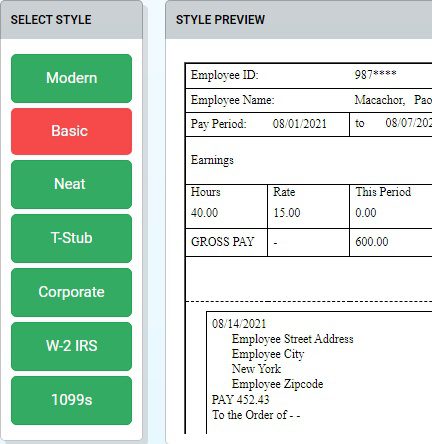

Is it possible to get a paystub generator with taxes? Absolutely. Finding a free paystub generator tool generally has the following parts.

Gross income

You record the whole of their gross pay prior to deductions. This is important for the sake of transparency and for helping your employees know that you are giving them their wages and the corresponding remittances which go with them. You must also take into account the kind of work hours and schedule they have.

Net pay

This is their pay with remittances in place. Their take home pay is vital because your employees need to know how much they’re getting on every pay period. It’s also good to find a paystub generator which gives you the following options.

State taxes

State income tax rates tend to be lower than federal tax rates. But having these on your paystub can keep things organized and the more you record this, the faster you get in accounting for your tax withholdings every time you create your paystubs.

Federal taxes

Of course there are some states which are tax friendly than others. But for the most part, federal taxes are usually remittances which are recorded on a consistent basis. Having this on your paystub template can help you work much faster in terms of making reconcilations and keeping track of the gross and net pay of your employees.

Commissions, overtime and healthcare

These parts of your free paystub generator are paramount because you want to make sure your employees know you are looking out for them. Having consistent structure in incentives can help keep your workers stay motivated and be happy for going to work with you!