Missouri Pay Stub Generator

Our Missouri paystub maker eliminates the need for creating paystubs from scratch, whether it’s for furnishing wage statements or presenting proof of income. It’s designed to have a built-in calculator and up-to-date information on Missouri taxes for accurate tax deductions and overall net pay. You can trust in the accuracy of your paystubs when you use our Missouri pay stub generator. Also, you get FREE unlimited previews and can choose from a selection of professional templates. If you need a printed or emailed copy of your Missouri paystub, you can avail of our affordable pricing plans.

Reasons You Should Use Our Missouri Payroll Stub Maker

Accurate

You can guarantee the accuracy of your paystubs with our Missouri paystub generator as it performs calculations on gross pay and net pay with the information you input. Our check stub maker eliminates the need for manual calculation, minimizing the risk of errors on your paystubs.

Affordable

If you want an affordable alternative from hiring a payroll professional or using costly payroll software, then our check stub maker is just what you need. Create Missouri paystubs for as low as $7.95. You can check out our affordable pricing plans for more information.

Easy-to-Use

Creating a professional Missouri paystub for employee payroll or proof of income purposes is simple with our paystub maker. All you have to do is enter basic information and salary details on our paystub template and our tool will instantly generate a paystub for you.

Free Paystub Generator for Small Business Owners & Independent Contractors in Missouri

Paystub Generator for Employee Payroll

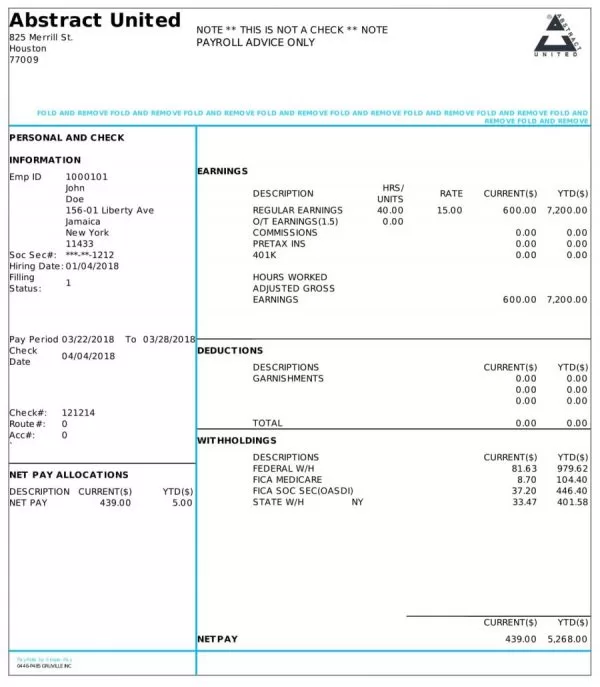

It’s required by the Missouri Department of Labor and Industrial Relations that any individual or any type of organization which employs one or more individuals to keep true and accurate payroll. The payroll statement should have the following information:

- Name with Social Security

- Place of Employment

- Pay Period

- Gross Wages

- Date Paid

By using our pay stub generator, you can create Missouri paystubs that are compliant with the requirements of the Department of Labor and Industrial Relations with regard to information presented on the paystub. You can guarantee accurate numbers on your Missouri paystub and professional paystub templates. We also have affordable pricing plans for you to avail depending on your business needs and budget.

Paystub Generator for Proof Of Income

When filing for taxes or applying for a loan, institutions in Missouri may require proof of income in the form of paystubs. Independent contractors, who may not have paystubs on a regular basis, may struggle with this requirement. Rather than manually making the paystubs yourself, our Missouri paystub maker can help produce paystubs quickly and easily. By inputting your legitimate basic information and salary details into the paystub template, you can instantly generate paystubs.

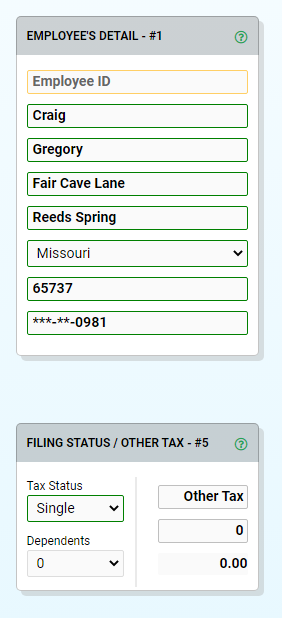

Our Payroll Stub Maker Can Deduct Your Taxes Automatically

Our Missouri pay stub generator simplifies the process of calculating taxes by automatically deducting them from your gross pay. Tax deductions are based on the tax status, rate of pay per hour, and state of residence you input. No need to spend time researching Missouri’s tax brackets or manually calculating the tax rate from your gross income.

Create Professional Paystubs with Our Missouri Pay Stub Generator

PayCheck Stub Online is an efficient and user-friendly solution for businesses looking to simplify their payroll process or for self-employed individuals in need of quick and easy Missouri paystubs for proof of income. It quickly generates professional and accurate paystubs for Missouri employees and complies with the Department of Labor and Industrial Relations requirements for paystub information.

It is also cost-effective, eliminating the need for expensive accounting software or hiring a payroll specialist. It’s simple to use for anyone, including those without knowledge of payroll or accounting. If you need a fast and easy tool for creating your Missouri paystubs, PayCheck Stub Online is the app you’re looking for.

Get free unlimited previews and affordable PDF copies. Don’t wait any longer and try it out today.

Missouri pay stub generator — practical guide

Most people land here because they need proof of income fast. The best-looking stubs are the boring ones: consistent dates, clear earnings, and deductions that aren’t a mystery.

In Kansas City, St. Louis, Springfield, the most common requests we see are for rentals, loans, and job onboarding.

How to make it look real and readable

Before you download, sanity-check the pay period and the pay date. Those two fields are what people compare across multiple stubs.

When pay is variable, clarity matters more than length. Separate overtime/bonus from base wages so the reviewer doesn’t have to guess what changed.

Quick checklist before you download

- If you work multiple jobs, keep each employer’s stub set separate (don’t mix identities on one stub).

- Keep the pay period dates tight and realistic — don’t use huge ranges unless that’s actually how you’re paid.

- Use consistent deduction names so stubs match each other over time.

Next: open the generator for a free preview, or review state-by-state requirements if you have a strict checklist. Pricing is here: pricing.

Reminder: always use truthful, accurate information and follow any requestor’s checklist.

Missouri pay stub FAQ

Do I need an account to preview?

No. You can preview first. Create an account if you want to save drafts or manage multiple stubs more easily.

What do most people check first?

Pay dates/periods, gross vs net, and that deductions are labeled clearly. If you’re hourly, hours × rate should line up with gross pay.

Can I generate multiple pay periods?

Yes. Keep the employer/employee info stable, then update only the dates and the numbers for each period so the set looks consistent.

Do I need to match a specific format?

If a lender/landlord/employer gave you a checklist, follow it. Otherwise, aim for readability: clear labels, consistent dates, and clean totals.