New York Pay Stub Generator

If you’re looking for a more cost-efficient way to make New York paystubs, our app is definitely the solution you’re looking for. Our check stub generator makes it easier for you to create professional and accurate NYC paystubs whether it’s for proof of income or employee payroll. It comes with a number of features that allows you to create stubs in just 5 minutes or less. Choose from our selection stub designs to make your New York paystub look more professional. Purchase a paystub for as low as $7.95 or get a 30% DISCOUNT when you purchase our unlimited stubs plan.

Reasons You Should Use Our App to Create an NYC Paystub

Accurate

You don’t have to worry about inaccuracies in your New York paystub with our paystub tool. In fact, it comes with a built-in calculator and the latest data on New York’s tax rate, so it can automatically give you the gross pay and net income. Expect error-free paystubs with our check stub maker.

Cost-Efficient

With our pay stub generator, you don’t have to pay a hefty amount of money to create a paystub for your employees in NYC or proof of income. You have a selection of stub designs for you to choose from and only have to pay as low as $7.95 to have a PDF copy of your stub. Get 30% OFF for unlimited stubs!

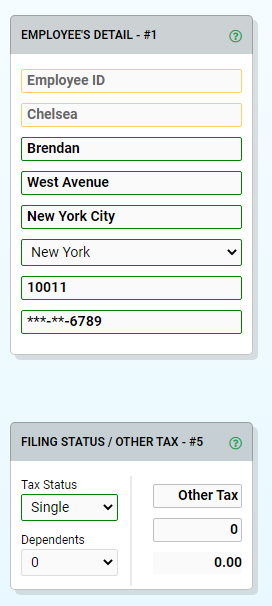

User-Friendly

You don’t need any technical skill in payroll or accounting to use our pay stub generator. It is designed to look like any other form, so all you need to do is fill out your basic information and salary details. Then, our app will do all the calculations and generate your New York paystub instantly.

Best Check Stub Maker for New York Small Business Owners & Freelancers

What Can Business Owners in NYC Get from Our Stubs?

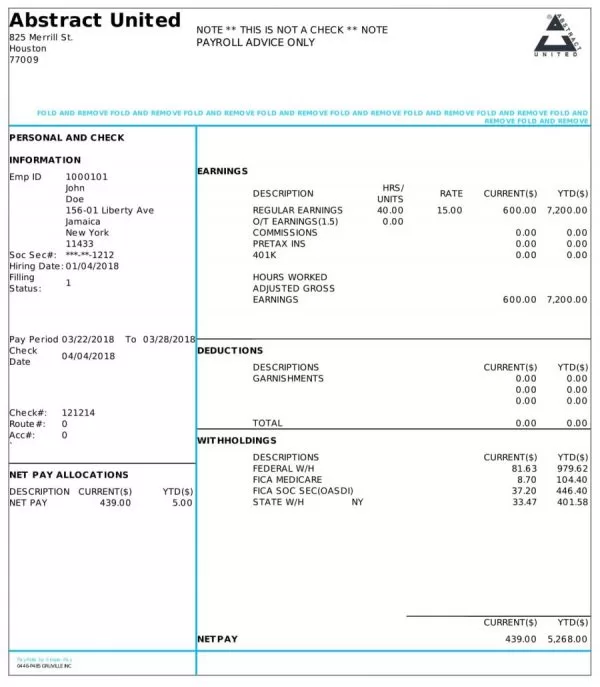

The New York Department of Labor requires every employer in the state of New York to furnish their employees with a wage statement. The statement of income must contain the following information:

- The start and end date of payment period

- Name of employee

- Name, address, and contact number of employer

- Rate or rates of pay

- Whether they’re paid by the hour, shift, day, week, salary, piece, commission, or other

- Gross wages

- Deductions

- Benefits

- Net pay

Using our payroll generator, you have a check stub that’s compliant with the requirements set by the state of New York’s Department of Labor. The process of creating employee paychecks doesn’t also have to be time-consuming. Create pay stubs online for your employees in an instant using our app.

How New York Freelancers Can Use Our Check Stub Maker App

If you’re applying for a loan or a mortgage from any New York institution, you might be required to hand in a proof of income. With this, you will need a NY pay stub calculator to create professional-looking paystubs. Make sure to provide your legitimate personal information and salary details on our pay stub template. Then, our tool will automatically generate your NY paystub.

Our Payroll Generator Can Deduct New York Taxes Automatically

Our paystub creator can automatically deduct taxes from the gross income as our tool was designed to have the latest data on the state of New York’s tax rates. All you have to do is provide the rate per hour, tax status, and state of residency then our pay stub creator will do all the math for you.

Know the state of New York’s Income Tax Withholding

The single filers and married jointly filing withholding tax table brackets and rates have changed as a result to the changes in formula for the tax year 2022. Learn more about New York’s current income tax withholding.

Amount of Taxable Income | Tax Withholding Rates |

Over $0 but not over $8,500.00 | 4.00% |

Over $8,500.00 but not over $11,700.00 | $340.00 plus 4.50% of excess over $8,500.00 |

Over $11,700.00 but not over $13,900.00 | $484.00 plus 5.25% of excess over $11,700.00 |

Over $13,900.00 but not over $80,650.00 | $600.00 plus 5.85% of excess over $13,900.00 |

Over $80,650.00 but not over $96,800.00 | $4,504.00 plus 6.25% of excess over $80,650.00 |

Over $96,800.00 but not over $107,650.00 | $5,514.00 plus 7.32% of excess over $96,800.00 |

Over $107,650.00 but not over $157,650.00 | $6,308.00 plus 7.82% of excess over $107,650.00 |

Over $157,650.00 but not over $215,400.00 | $10,219.00 plus 6.75% of excess over $157,650.00 |

Over $215,400.00 but not over $265,400.00 | $14,117.00 plus 9.94% of excess over $215,400.00 |

Over $265,400.00 but not over $1,077,549.99 | $19,085.00 plus 7.35% of excess over $265,400.00 |

Over $1,077,549.99 but not over $4,999,999.99 | 10.45% |

Over $4,999,999.99 but not over $24,999,999.99 | 11.10% |

Over $24,999,999.99 | 11.70% |

Taxable Income | Tax Withholding |

Over $0 but not over $8,500.00 | 4.00% |

Over $8,500.00 but not over $11,700.00 | $340.00 plus 4.50% of excess over $8,500.00 |

Over $11,700.00 but not over $13,900.00 | $484.00 plus 5.25% of excess over $11,700.00 |

Over $13,900.00 but not over $80,650.00 | $600.00 plus 5.85% of excess over $13,900.00 |

Over $80,650.00 but not over $96,800.00 | $4,504.00 plus 6.25% of excess over $80,650.00 |

Over $96,800.00 but not over $107,650.00 | $5,514.00 plus 7.11% of excess over $96,800.00 |

Over $107,650.00 but not over $157,650.00 | $6,285.00 plus 7.61% of excess over $107,650.00 |

Over $157,650.00 but not over $211,550.00 | $10,090.00 plus 8.04% of excess over $157,650.00 |

Over $211,550.00 but not over $323,200.00 | $14,425.00 plus 6.75% of excess over $211,550.00 |

Over $323,200.00 but not over $373,200.00 | $21,961.00 plus 11.23% of excess over $323,200.00 |

Over $373,200.00 but not over $1,077,550.00 | $27,576.00 plus 7.35% of excess over $373,200.00 |

Over $1,077,550.00 but not over $2,155,349.99 | $79,346.00 plus 7.65% of excess over $1,077,550.00 |

Over $2,155,349.99 but not over $4,999,999.99 | 10.45% |

Over $4,999,999.99 but not over $24,999,999.99 | 11.10% |

Over $24,999,999.99 | 11.70% |

Create NYC Pay Stubs Online with Our Pay Stub Generator

Relying on payroll programs or accountants might not be cost-efficient for you as a small business owner in New York. At the same time, making your paystubs manually might be time-consuming for independent contractors who may need it as proof of income. With this, this, we’ve got a more quick while accurate tool for you to use to create your New York paystubs.

Our paystub creator boasts a simple interface and features that will help you generate paystubs in 5 minutes or less. It comes with a built-in calculator, so you don’t have to worry about pulling out your calculator and doing the math on your gross income and net pay yourself. Just type in the information required and our New York pay stub generator will do it for you. You can then choose from our selection of templates, so you can present a professional stub. Get a copy of your paystub for as low as $7.95 or get a 30% Discount when you purchase our unlimited paystubs plan.

In 2023, New York minimum wage of $14.20 /hr. Although Special minimum wage rates, such as the “New York waitress minimum wage” for tipped employees, for certain workers like wait staff.

It is illegal to falsify any official documents including paystubs. Simply report accurate information that represents your income and use a generator with good calculations and you should be fine.