How long should we keep payslips?

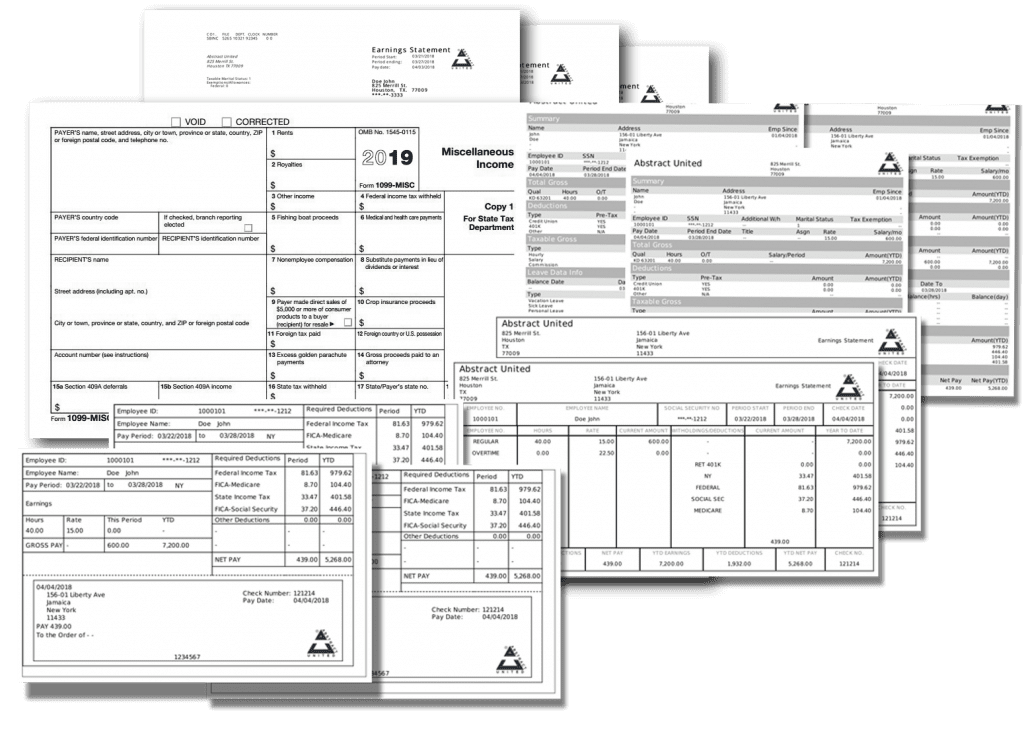

2 years. That’s what’s often the recommended time for keeping and holding on to your payslips. But what if you can use an online check stub tool which can allow you to hold on to your paystubs indefinitely?

To help you keep payslips more consistently, you can view our pay stub pricing here.

If anyone has ever had a job, they know what payslips are. But have you given much thought as to long long you should keep your payslips? There aren’t any hard and fast rules but hopefully the following article will give you some clues.

What are payslips?

Payslips are typically notes given to employees every pay period. Your employees, in short will receive payslips for every period depending on how often you remit salaries. So if you pay your employees monthly, they ought to get 12 payslips a year.

If you pay them twice a month, they might be getting 24 pay slips. All that is beside the point. What you need is a paystub maker that can allow you to integrate your workflows faster and efficiently.

Sometimes, there are many reasons to hold on to your paycheck stubs. They can be a useful references if you want a proof of income letter for instance, if you want to make a rent and proceed with other transactions. You can also use them to calculate W2 wages when you file income taxes. There are no hard and faster answers.

It’s always good to be thorough in your financial records however. Of course, to reduce clutter you may need to remove those paystubs you no longer need.

Here are some of the ways you can tell if you need to throw away your own payslips.

Tax returns

Filing income taxes is important and this applies to whether you’re an employee or an employer. It’s vital to keep careful track of your income and your remittances so that you can save these for future use because you may make purchases or secure loans and these may come in handy depending on what state you’re living.

Payment problems

If you’ve overpaid taxes or you need to make corrections, then holding on to your payslips or even your paycheck stubs can be fundamental. There needs to be a way for you to pull them up any time for the sake of bookkeeping and make some financial reconciliations if you see the need to adjust some transactions in the future.

Proof of pension

If you want to get things ready for your 401k then having paystubs or payslips in order to showcase proof is paramount. In an ideal situation, you would not need these because there are government records, but it always helps to make sure that you keep your payslips for the purpose of pension.

Purchasing a house

If you want to rent an apartment, then it is absolutely vital to make sure you have financial records and transactions. Your payslips are going to help show proof of your income, your tax withholdings and even some insurance if that is what it takes. The specifics are up to you but it’s a helpful affair if you have these all on file.

Get your paycheck stub generators right now so you can come up with your own filing system for payslips.