Welcome to our series on how to make a pay stub for free, in 5 steps. Fully detailed. If you haven’t read the first part of this series, here is a link to Step 1 of how to make a pay stub

We are at the part where we show you how to perform Calculations on the pay stub form.

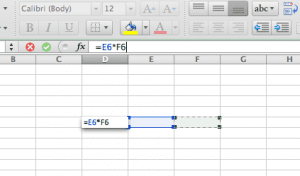

First, you have to know how to use Excel. Basically, a spreadsheet document is full of cells, that interact with each other, and the way they interact is with “formulas”. These formulas can be very easy, to very complicated. For Pay stubs, it’s relatively easy. In English, it’s basically “Cell 1, multiplied or added or divided by Cell 2, is equal to Cell 3.

It looks like this in mathematics terms:

CELL 1 + CELL 2 = CELL 3

An in Excel, it looks like this:

D6 = E6 * F6

The fact that it’s D and it’s 6 doesn’t matter. that’s just which cell I selected, and they could have been anyone…

And the way you write it, is really simple, with the aid of Excel. You just select the Cell with your mouse that you want the final number to be in, and then hit the ‘=’ key. That tells Excel that you want to write an equation. Using your mouse, you can select any cell you want. I selected E6 then you select the ‘operator’ like PLUS or TIMES or DIVIDE. In my example, I put the asterisk, * which means MULTIPLY. And then, with your mouse, select the cell you want to multiply by, which is F6 in my example.

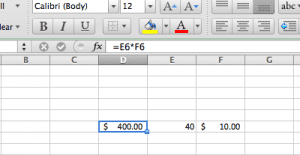

A good example would be, if you want to figure out how much you would make in one pay period, you would multiply your hours * pay-rate.

Let’s say you put your pay rate of $10 in cell E6 and your hours as 40 in F6. You would do exactly as I said above, click the appropriate cells, and you would have a result in the first cell. You have the basics of formula, you can do all the calculations.There are a few, and you’ll have to add the ones you need.

This is the primary:

GROSS PAY = HOURLY * PAY RATE

DEDUCTIONS = STATE tax + FEDERAL tax + Medicare + SSN + Fica

FEDERAL tax = GROSS PAY * Your tax bracket

STATE tax = GROSS PAY * Your tax bracket

MEDICARE = same

SSN = same

FICA = same

NET PAY = GROSS pay – DEDUCTiONS

Any other options you want to subtract or add are additional, and it is out of the scope of this article. If you want a more detailed option, you can use our pay stub maker and just add what you want, and our software will do all the appropriate calculations for you, in our pay stub templates.

Stay tuned for our next article, on how to make a pay stub for free series.